Mandatory Due Diligence in Hyderabad Real Estate – Your Best Defense Against Risks & Scams

Introduction

Hyderabad’s real estate market is one of the fastest-growing in India, attracting homebuyers, NRI investors, and high-net-worth individuals alike. The combination of IT growth, expanding infrastructure, and rising property values has created immense opportunities. But with opportunity also comes risk.

In recent years, the city has witnessed a rise in frauds, scams, and disputes — from double registrations to illegal constructions. In this environment, Mandatory Due Diligence is no longer optional. It is the first line of defense every buyer must exercise to safeguard their money and avoid long legal battles.

This blog covers the step-by-step due diligence process that every serious buyer or investor should follow before purchasing property in Hyderabad.

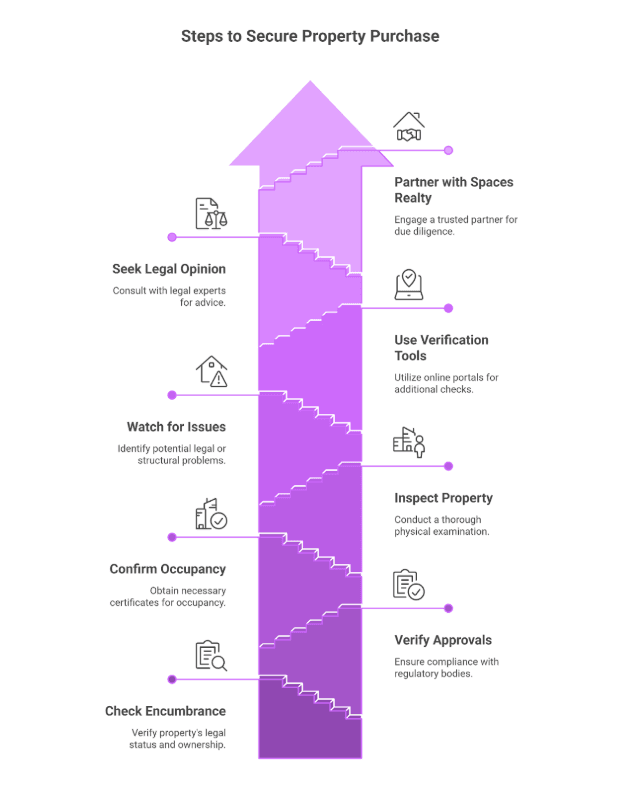

1. Verification of Legal Documentation & Property Title

The foundation of due diligence is ensuring that the property has a clean and undisputed title. Without this, your investment could become worthless.

Encumbrance Certificate (EC):

- Shows the history of sales and purchases linked to the property.

- Ideally, buyers should check 50 years of history to confirm clear ownership.

- Ensures no outstanding mortgages, debts, or legal disputes.

Link Documents & Clean Sale:

- These documents connect the ownership chain back to the original seller.

- Missing links may signal disputes, inheritance claims, or fraudulent sales.

Property Title Deeds:

- Buyers must verify that the title is clear and legally valid.

- Even villas and luxury properties should be scrutinized for clean ownership.

Avoiding Multiple Registrations (Scams):

- A common fraud in Hyderabad is double or triple registration of the same land.

- Always confirm that if there are multiple deeds, corresponding cancellation deeds exist.

Bank Vetting (Safety Net):

- Even if you don’t need a loan, consider taking a small loan (₹5–10 lakhs).

- Banks independently vet documents before approving, adding an extra layer of safety.

- Caution: Don’t rely only on the bank; do your own checks as well.

Dharani Portal Check:

- Use Telangana’s Dharani Portal to cross-check ownership and legal status.

- Ensures the land is not under dispute or government ownership.

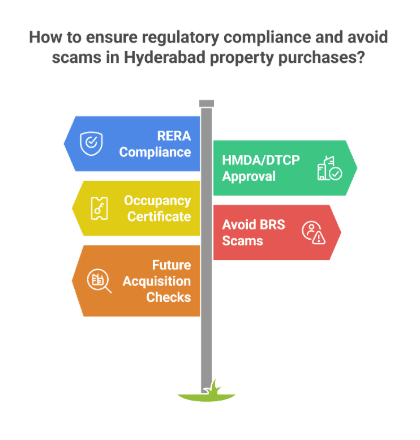

2. Regulatory Compliance & Government Approvals

Many scams in Hyderabad involve unapproved layouts and illegal constructions. Proper regulatory checks can save you from demolition notices or heavy fines later.

RERA Compliance:

- Choose projects registered under RERA Telangana.

- RERA ensures the builder meets quality and legal standards, and buyers can track project progress.

HMDA/DTCP Approval:

- All layouts and apartments must be approved by HMDA or DTCP.

- Without approval, buyers risk their investment being declared illegal construction.

Occupancy Certificate (OC):

- For apartments, confirm that the builder has obtained the Occupancy Certificate.

- Without OC, you may face problems with electricity, water, and resale.

BRS Scams (Building Regulation Scheme):

- Beware of builders promising to “legalize” illegal construction by paying fines under BRS.

- Many such claims are fraudulent and non-binding.

Future Acquisition Checks:

- Always check GHMC plans and municipal maps.

- Fraudsters sometimes sell land earmarked for government projects (like roads or flyovers).

3. Physical & Financial Due Diligence

Paperwork alone is not enough — you need to evaluate the physical property and financial aspects.

Home Inspection:

- Conduct professional inspections for villas, apartments, or resale flats.

- Checks for structural quality, plumbing, wiring, and hidden repair costs.

Builder Reputation:

- Investigate the developer’s track record.

- Established builders typically ensure legality, tie-ups with banks, and better resale value.

Price & Valuation Checks:

- Don’t rely only on broker quotes.

- Compare prices using TS Registration & Stamps website and recent sales in the area.

- Avoid inflated prices advertised online.

Legal Opinion:

- Always consult an independent property lawyer (not just the builder’s).

- A lawyer can validate title deeds, approvals, and ownership history.

4. Avoiding Scams & High-Risk Situations

- Several common traps in Hyderabad real estate can be avoided with careful due diligence.

- Double Registration & Title Issues:

- Widely reported in Hyderabad — ownership disputes can drag buyers into endless litigation.

Government Land Risk:

- Some fraudsters sell government-assigned land (meant for agriculture or rehabilitation).

- Such land cannot be legally sold, and buyers may face eviction.

Broker Dependency:

- Plotting markets are often dominated by local brokers, who may mislead buyers.

- Always insist on direct verification with developers and government records.

Off-Plan Purchases:

- Avoid booking flats with handovers more than 12–18 months away.

- Delays can lock up your funds for years, while you continue paying EMIs.

Key Takeaways

- Always check Encumbrance Certificates & title deeds.

- Verify approvals from RERA, HMDA, DTCP.

- Confirm Occupancy Certificates for apartments.

- Inspect property physically and check builder reputation.

- Watch out for double registrations & illegal layouts.

- Use Dharani Portal & GHMC maps for verification.

- Take legal opinion before signing.

Spaces Realty = your trusted due diligence partner.

Conclusion Hyderabad offers incredible real estate opportunities — from premium villas and gated communities to high-growth commercial assets. But with this growth comes risks of scams, legal disputes, and fraudulent practices. The solution is simple: Mandatory Due Diligence. By thoroughly verifying documentation, regulatory approvals, and builder credibility, buyers can protect their wealth while tapping into Hyderabad’s booming property market. At Spaces Realty, we take due diligence seriously. Every property we recommend is vetted, approved, and verified for clean ownership and compliance. This ensures our clients enjoy not just returns but also peace of mind.