Hyderabad’s Premium Real Estate Surge: West and South Zones Drive ₹50,000 Crore in Property Registrations- What It Means for Investor

Hyderabad’s Premium Real Estate Surge: West and South Zones Drive ₹50,000 Crore in Property Registrations- What It Means for Investor

Hyderabad’s real estate market continues to outperform national trends, emerging as one of India’s most stable yet lucrative investment destinations. Backed by strong infrastructure growth, a robust IT and industrial base, and consistent investor demand, the city is witnessing record-breaking registration values and steady appreciation in premium properties.

Among its key corridors, West Hyderabad remains the undisputed leader, while South Hyderabad is quickly transforming into the next powerhouse for plotted and high-value land investments. Together, these two zones form the city’s dual growth engine — combining immediate capital performance with long-term potential.

West Hyderabad: Hyderabad’s Premium Powerhouse

Over the last decade, West Hyderabad has evolved into India’s most consistent and high-performing real estate corridor. Anchored by the IT hub of Gachibowli, Kokapet, Narsingi, Financial District, and Tellapur, the region has become synonymous with premium living and investment-grade assets.

Why Investors Prefer the Western Corridor

- Corporate and Infrastructure Backbone – Home to global tech giants like Microsoft, Amazon, and Google, this zone remains the financial and employment nucleus of Hyderabad. High ROI Zone – Average appreciation in premium projects has ranged between 20–35% over the past five years.

- Infrastructure Edge – With the Outer Ring Road (ORR) and upcoming Airport Metro Line, connectivity and demand have both skyrocketed.

- Investor Profile – Dominated by HNIs, NRIs, and institutional investors, the region’s buyers seek legacy wealth through tangible assets.

West Hyderabad Registration & Investment Data (2024–25)

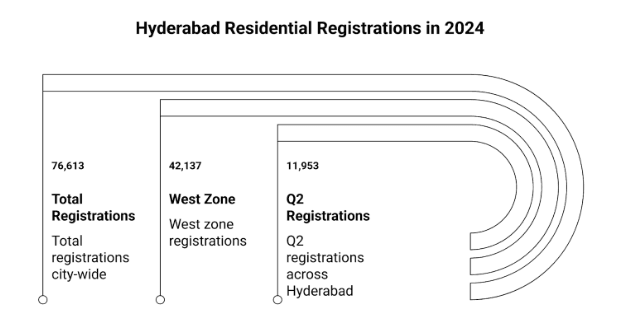

- In 2024, Hyderabad saw 76,613 residential registrations, with an estimated ₹ 45,000 crore in transaction value city-wide.

- The West zone accounted for roughly 55% of that — translating to ₹ 24,750 crore worth of transactions.

- For 2025, the city is tracking a value of nearly ₹ 50,000 crore, with the West expected to contribute ₹ 27,500 crore.

- Quarter-wise, property values have shown strong momentum — Q2 2024 alone saw transactions worth ₹ 11,953 crore across Hyderabad.

These figures reflect a maturing, premium market where investors aren’t just buying homes — they’re acquiring long-term wealth assets.

South Hyderabad: The Emerging Investment Magnet

While West Hyderabad remains established, the Southern corridor - encompassing Shamshabad, Maheshwaram, Kandukur, and Shadnagar — is gaining fast momentum as Hyderabad’s next investment destination.

Growth Catalysts in the South

- Airport Advantage – The Rajiv Gandhi International Airport (RGIA) anchors this zone, creating strong linkages with logistics, hospitality, and corporate travel ecosystems.

- Industrial & Infrastructure Push – Projects like Pharma City, Hardware Park, and Regional Ring Road (RRR) are transforming the investment landscape.

- Premium Plotted Boom – Investors are increasingly seeking premium plotted developments that offer both affordability and long-term ROI.

- Government-Driven Expansion – Strategic master plans, widening corridors, and emerging SEZs are driving both registrations and land absorption.

South Hyderabad Numbers & Forecast

- In 2024, South Hyderabad accounted for about ₹ 11,250 crore worth of property registrations (≈ 25% of city total).

- By 2025, that number is expected to reach ₹ 12,500 crore, representing a 12% YoY growth.

- Over the next 2–3 years, South Hyderabad is expected to grow at 12–15% annually, taking total registrations to ₹ 14,000 crore in 2026 and ₹ 15,700 crore in 2027.

This surge is driven by the region’s affordability advantage and high infrastructure visibility, positioning it as Hyderabad’s next high-yield land corridor.

West vs South Hyderabad: Comparative Investment Insights

Hyderabad’s real estate market shows distinct dynamics between its Western and Southern zones, making each area uniquely attractive to different types of investors.

In 2024, property registrations in West Hyderabad totaled approximately ₹24,750 crore, far higher than South Hyderabad at ₹11,250 crore, reflecting the West’s mature market and strong demand for luxury apartments and villas. The West primarily caters to HNIs, NRIs, and institutional investors, with capital appreciation as the main ROI driver.

For 2025, West Hyderabad is projected at ₹27,500 crore, and South at ₹12,500 crore. By 2026–27, West may reach ₹32,100 crore, while South could grow to ₹15,700 crore. The CAGR highlights the contrast: 8% for West versus 13% for South, driven by the latter’s rapid development, infrastructure expansion, and rising demand for premium plotted developments.

Why Premium Investors Are Choosing Land Over Built Assets

In today’s investment landscape, land continues to outperform other asset classes. Unlike high-rise inventory with saturation risks, premium plots combine liquidity, low maintenance, and capital safety.

Market Data Supports the Shift

- In June 2025, Hyderabad’s total residential property value touched ₹ 4,587 crore, with premium homes (>₹ 1 crore) accounting for 51% of the value share.

- The premium segment grew 37% YoY, underscoring a decisive shift toward luxury and high-end plotted communities.

- This reinforces the growing investor preference for exclusive gated developments like Silpa Botanica — properties that blend location, design, and capital growth.

Silpa Botanica: The Benchmark of Luxury Land Investment

At the intersection of Hyderabad’s rising southern belt and the western growth axis lies Silpa Botanica, a landmark plotted development presented by Spaces Realty. Crafted for high-net-worth investors, it delivers luxury, exclusivity, and long-term investment security.

Project Highlights

- Premium Gated Development with wide roads, landscaped zones, and curated civic infrastructure.

- Strategic Location with easy access to both Airport Corridor and Financial District.

- Designed for Investors — a project created for legacy wealth creation, not just residential living.

- High Capital Appreciation Potential, backed by limited supply and rising premium land demand.

Explore this exclusive investment opportunity here: Silpa Botanica by Spaces Realty.

Final Outlook: Hyderabad’s ₹ 50,000 Crore Market Is Just the Beginning

With Hyderabad’s property market surpassing ₹ 50,000 crore in annual transactions and both West and South zones witnessing double-digit growth, the city stands at the cusp of its next real estate supercycle. For discerning investors, the next 24–36 months represent the most strategic window to acquire premium land assets — before the next appreciation wave fully materializes.

In this landscape of opportunity, Silpa Botanica stands as a testament to thoughtful design and strategic foresight — a premium plotted community designed not just to grow in value, but to redefine luxury living in Hyderabad.

Discover more premium investment opportunities at: Spaces Realty — Hyderabad’s most trusted partner for high-value, performance-driven and truly free real estate investments and property listing platform.

Sources: